The bull is dead.

But no one’s told your portfolio yet.

Volatility is flaring. Headlines are swinging from panic to euphoria. One day it’s a crash, the next it’s a 10% rally. Every move feels like a trap.

Trump announced a 90-day pause on most tariffs two days ago — a headline that lit up screens and triggered a wave of panic buying.

But the truth is, the pause doesn’t matter.

The tariffs don’t matter.

The market’s foundation was cracking even before Trump’s infamous tariff announcement.

Yet most traders are still clinging to the idea that we’re in a temporary pullback, believing the bull will get back up and start charging again.

It won’t.

And if you don’t change your mindset (and your strategy) fast, you’re going to bleed out chasing setups that no longer work.

But here’s the good news…

Traders who adapt will make a killing in the weeks ahead.

Today, I’ll show you exactly how to reframe your thinking, reset your playbook, and approach this market with a strategy designed for this kind of chaos — not the environment we wish we were still inhabiting.

I’ll talk about what to watch, what to avoid, and how to position yourself to stay in control.

Let’s get started…

Nothing Good Happens Here

First, we need to map out where we are in the market cycle.

The news remains mostly negative. The tariff situation has evolved, but it hasn’t gone away (and won’t anytime soon). Volatility remains elevated. Aside from a brief pop last August during the yen panic, we have not seen a sustained move in the VIX like this since the COVID crash.

Then there’s the news…

Headline risk can work both ways since investors are clearly nervous. They’re searching for any information they can to confirm their biases — and will likely overreact to every major news story.

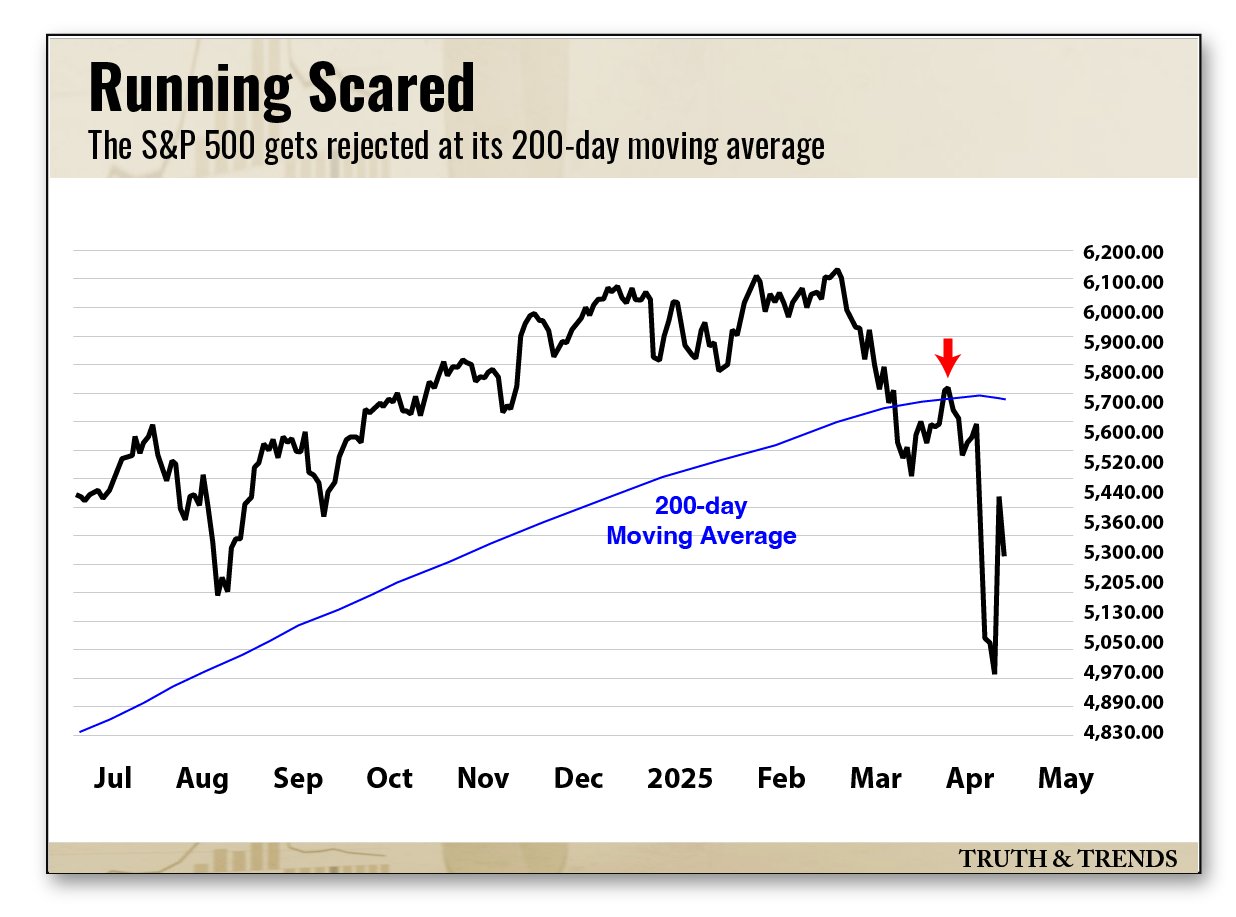

More importantly, the averages remain below their respective 200-day moving averages. Yes, we witnessed a historic rally on Wednesday, the second-largest ever one-day move in the Nasdaq to boot.

But these massive moves are bear market behavior. As chart watchers like to say, nothing good happens below the 200-day moving average.

That’s certainly been the case this month. The new lows list is miles longer than the new highs. And we haven’t experienced a trading day with an intraday move less than 1% since the S&P was rejected at its 200-day moving average back on March 25th.

Prognosis: expect bear market action to continue, complete with failed rallies and larger-than-average intraday swings.

Beware Big Rallies

We experienced a monstrous rally on Wednesday after Trump tripled down on China and declared a 90-day tariff pause for the rest of the world.

It was the most ferocious rally we’ve seen in years. The S&P finished the day higher by more than 9.5%, while the Nasdaq Composite ended the day up an eye-popping 12%.

But if we look to history, we know that explosive relief rallies like the one we witnessed earlier this week occur in bear market environments.

It was the second-best performing day ever for the Nasdaq. Its best ever? Jan. 2001 — the heart of the dot-com unwind.

Other historical up days occurred during major downside events. The Great Financial Crisis. The Crash of ‘87. Each of these events featured gigantic relief rallies.

One of the most important actions you can take during a corrective market is to get the hell out of the way. If you want to make money in the long-term, you have to avoid taking outsized losses.

Recognize that these big relief rallies happen during bear market conditions. Then, make it a point to avoid chasing them!

Corrective Conditions, Not Crashes

Investors tend to fret over the market crashing during corrective periods. But the crash isn’t always your worst enemy.

Instead, you need to worry more about navigating market chop, relief rallies, and other maddening conditions you’ll encounter as we wait for the market to find a floor.

Here’s how to deal with different bear market scenarios:

Use big relief rallies like we saw on Wednesday as an opportunity to “get right” with any broken plays that might be weighing you down. Sell longs into strength and aggressively take profits on these big upside days.

Watch for gaps! Wednesday’s rally filled one of last week’s big downside gaps in the S&P, yet fell short of the gap at 5,500. That’s yet another air pocket the bulls will need to contend with in the days and weeks ahead. These areas can act as stiff resistance as the market attempts to recover.

Play the extremes, but sit out during the slop. It’s tempting to try to ride the euphoria of a big, one-day rally or go short as the market melts down. But the big moves aren’t gaining any traction right now. This is the time to sit on your hands. Once the rubber band becomes stretched, you’ll get a shot at playing the extremes again.

There’s a hint of panic in the air as the week draws to a close, and we’re seeing erratic moves in stocks. That’s not a good environment to make any targeted, higher-probability bets.

But once the market fights through this latest bout of volatility, we’ll get additional relief rallies and other higher-quality setups to play.

If you can preserve your capital now, you’ll have an excellent shot at winning big when stocks retest their lows, or when the averages are able to break through resistance and mount a sustainable rally.