This post The Art of *Currency* War appeared first on Daily Reckoning.

The U.S. dollar remains the king of currencies. For now, at least.

The greenback’s share of global foreign exchange reserves sits around 58%. However, back in 2000 the dollar was even more dominant with a 72% market share.

Meanwhile China’s yuan only makes up about 2.2% of global forex reserves, but that’s up from 1.1% in 2016. The currency’s share of global payments is higher at around 4.7%.

China’s leadership is now making a push to grow the yuan’s role as both a reserve currency and in payment. Specifically, the country is seeking to take advantage of recent U.S. bond market volatility.

“The recent soaring volatility in the US Treasury market marks a watershed event”, according to Yang Changjiang, a finance professor at a leading Chinese university.

Yang went on to say, via the South China Morning Post:

We used to consider trade settlement as the key driver of the yuan’s internationalisation, but now the focus has shifted to whether the yuan can serve as a safe-haven asset. This is an opportunity that we must seize.

The Chinese yuan as a “safe-haven asset”? That would be a surprising development, but a possibility worth paying attention to.

China is gobbling up gold and attempting to internationalize its currency. They’re clearly planning something big here, so as investors it’s our job to attempt to sniff out what that might be. Any change in the global monetary order will have immense effects across asset classes, so we must pay attention.

China Challenges SWIFT

SWIFT is the U.S.-controlled international bank messaging system which enables global payment and trade.

SWIFT is the backbone of international finance, with a dominant market share.

However, China has an up-and-coming competitor. It’s called the Cross-Border Interbank Payment System (CIPS). Unlike SWIFT, which is only a messaging app which facilitates bank communication, CIPS also has a built-in payment mechanism.

CIPS is growing fast. In 2024 it processed 175 trillion yuan worth of transactions ($24 trillion), which was up 42% year-over-year.

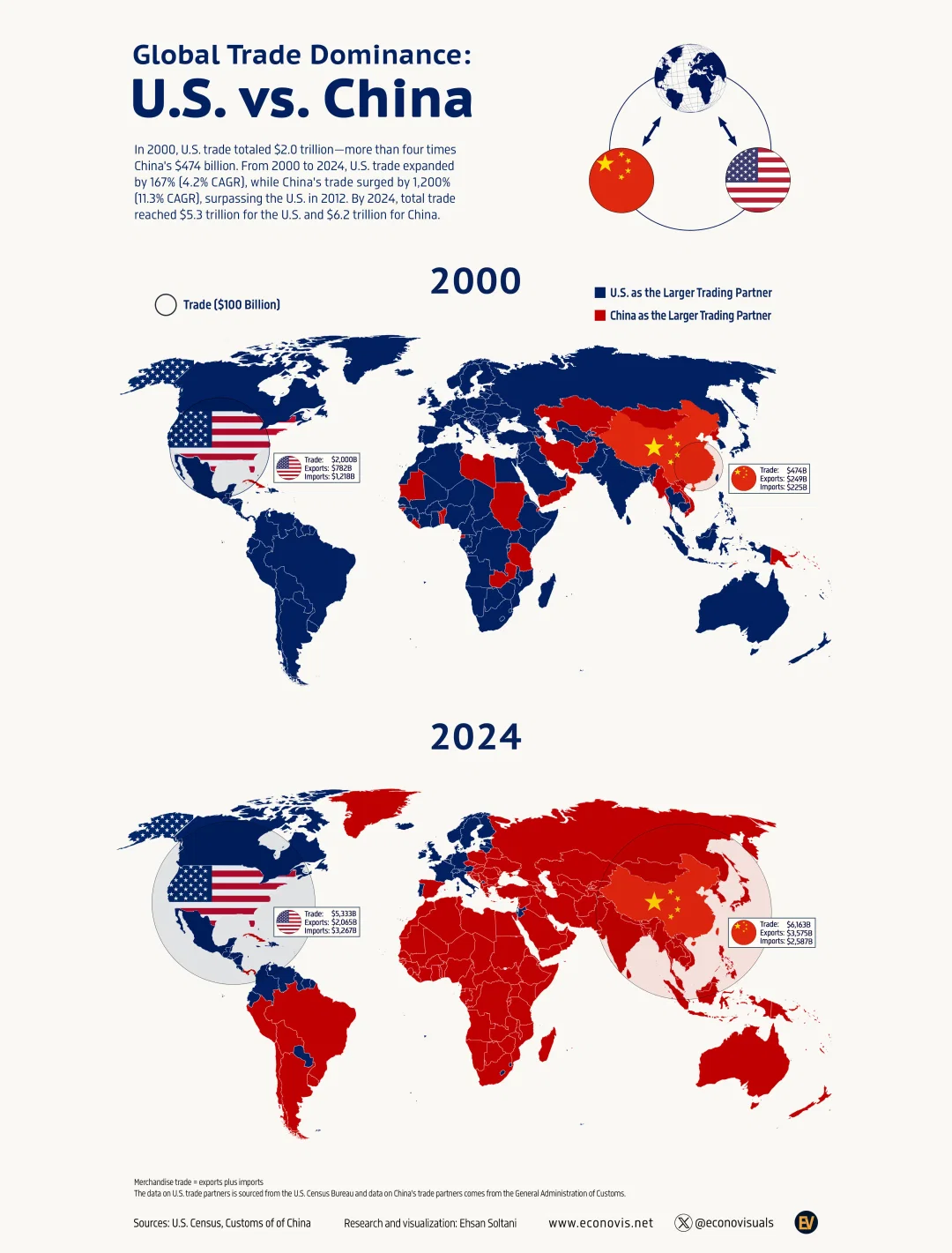

China is the top trading partner with more than 120 countries worldwide, and an increasingly large percentage of that trade is being conducted in yuan rather than dollars.

In the chart below, you can see how since 2000, China has taken over as the largest trading partner for most of the world. Countries who count the U.S. as their largest trading partner are in blue, and China in red.

Source: Econovis

Despite China’s trade dominance, many countries are still reluctant to use Chinese currency as a reserve asset and payment mechanism.

And while China has become dominant in the sale of physical goods, America’s primary export (dollars) is still going strong. Old habits die hard. The dollar has been dominant for so long that it will take a long time for this to change.

Gold and the Changing Monetary Order

President Trump seems to want a weaker dollar, so one wonders if this is potentially an area where America and China could find common ground.

At the same time, Trump clearly wants the dollar to remain as the global reserve currency. And these two goals don’t necessarily clash.

After the 1985 Plaza Accord, when the U.S. intentionally devalued the dollar by up to 50% against other major currencies, the greenback remained the king of currencies.

So there is a path where Trump could both weaken the dollar, which would be a boost for our exporters, and remain the world’s top reserve currency. But make no mistake, this is walking a thin tightrope. There’s little margin for error.

Meanwhile, global central banks continue to increase their gold reserves at a stunning pace. And up to 2,000 tons of gold have rushed into the U.S. so far this year. Clearly something strange is happening in the world’s monetary landscape.

Adding to the intrigue was Trump’s mysterious post on Truth Social this week:

THE GOLDEN RULE OF NEGOTIATING AND SUCCESS: HE WHO HAS THE GOLD MAKES THE RULES. THANK YOU!

The monetary world order is shifting for the first time in ages. The age of fiat currency dominance is fading.

We will continue to monitor the situation and report back with updates. In the meantime, I advise allocating a healthy percentage of your portfolio to gold, silver, and miners.

No matter how the next few years and decades play out, the only thing I’m sure about is that precious metals have an increasingly important role to play. The monetary chaos is just beginning, and gold and silver stand to be the primary beneficiaries.

The post The Art of *Currency* War appeared first on Daily Reckoning.